Phoenix, Arizona--(Newsfile Corp. - December 14, 2023) - Excelsior Mining Corp. (TSX: MIN) (FSE: 3XS) (OTCQB: EXMGF) ("Excelsior" or the "Company") is pleased to announce that it and its wholly-owned subsidiary Excelsior Mining Arizona, Inc. ("Excelsior Arizona") have closed a $5.5 million financing (the "Financing") with Greenstone Excelsior Holdings LP ("Greenstone") and Triple Flag USA Royalties Ltd. ("Triple Flag"). The closing of the Financing was a condition subsequent to the previously announced extension of the maturity date of its existing $15 million credit facility with Nebari Natural Resources Credit Fund I LP ("Nebari") to June 30, 2026. All dollar amounts in this press release are in United States dollars.

Dr. Stephen Twyerould, President & CEO of Excelsior, commented: "Closing this transaction with such strong support from our key stakeholders demonstrates we are on the right path. We look forward to 2024 with several transformational opportunities ahead of us, and our aim, with the support of our partners, is to actualize those opportunities."

Financing

On December 14, 2023, the Company closed a transaction with Triple Flag and Greenstone on the following terms: (i) Greenstone has sold 1.5% of its total 3% gross revenue royalty on the Johnson Camp Mine to Triple Flag for consideration of $5.5 million in cash (the "Royalty Sale"); and (ii) Greenstone has concurrently completed a $5.5 million financing with the Company that consists of $3.1 million in Common Shares (the "Share Offering") and $2.4 million principal amount of convertible debentures (the "Debenture Offering").

Pursuant to the Share Offering, the Company issued Greenstone a total of 27,180,000 Common Shares at a price of $0.11405 (C$0.155) per Common Share for aggregate gross proceeds of $3.1 million (C$4,212,900).

Pursuant to the Debenture Offering, Greenstone was issued $2.4 million (approximately C$3,254,640, based on an exchange rate of US$1:C$1.3561 on December 13, 2023) principal amount of convertible debentures (the "Debentures") by the Company. The terms of the Debentures are set out in the Company's press release dated November 30, 2023.

The Company intends to use the proceeds of the Share Offering and Debenture Offering for project development expenses and working capital.

Additional Information

Nebari and Triple Flag are at arm's length to the Company. There are no commissions or finders' fees payable in connection with the transactions discussed in this news release.

Greenstone and its affiliated entities previously held 116,028,937 Common Shares (representing 41.86% of the Company's current issued and outstanding Common Shares). Greenstone also owns and controls 1,250,000 options to acquire Common Shares and a convertible debenture with principal amount of $1.5 million that is convertible into 7,894,736 Common Shares. As a result of the closing of the Share Offering and Debenture Offering and conversion of the Debentures held by Greenstone (assuming conversion of all interest payments on the maturity date, using a conversion price of US$0.11405 and a SOFR rate of 5.3307%), Greenstone would acquire ownership and control over an additional 57,383,369 Common Shares, representing approximately 20.7% of the Company's current issued and outstanding Common Shares. As a result, together with the Common Shares it currently owns and controls, Greenstone would hold a total of 173,412,306 Common Shares, which will represent, in aggregate approximately 51.83% of the issued and outstanding Common Shares (assuming conversion of only the Debentures held by Greenstone and assuming the conversion of all interest to maturity at US$0.11405). Greenstone acquired the Debentures and the Common Shares for investment purposes. Depending on market conditions and other factors, Greenstone may from time to time acquire and/or dispose of securities of Excelsior or continue to hold its current position. A copy of the early warning report required to be filed with the applicable securities commission in connection with the acquisition of the Debentures and Common Shares will be available on SEDAR+ at www.sedarplus.com and can be obtained by contacting Gavin Hayman at +44 1481749700. Greenstone's address is set out below:

Greenstone contact information:

Greenstone Excelsior Holdings LP

PO Box 656, East Wing, Trafalgar Court,

Les Banques, St. Peter Port, Guernsey

GY1 3PP

Channel Islands

Pursuant to Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101"), Greenstone's participation in the Share Offering and Debenture Offering constitutes a "related party transaction" as Greenstone is a related party of the Company. The Company is relying on an exemption from the formal valuation and minority shareholder approval requirements of MI 61-101 pursuant to exemptions contained in sections 5.5(a) and 5.7(1)(a) of MI 61-101 on the basis that at the time Greenstone's participation in the Share Offering and Debenture Offering was agreed to, neither the fair market value of the securities to be distributed in the Share Offering and Debenture Offering nor the consideration to be received for those securities, insofar as the Share Offering and Debenture Offering involved the related party, exceeds 25% of the Company's market capitalization. The Company did not file a material change report related to this financing more than 21 days before the closing of the Debenture Offering as required by MI 61-101 since the details of the participation by the related parties of the Company were not settled until just prior to closing and the Company wished to close on an expedited basis for sound business reasons. The Common Shares that will be acquired by Greenstone were acquired pursuant to an exemption from the prospectus requirement in section 2.3 of National Instrument 45-106.

In order to facilitate the completion of the Royalty Sale, Share Offering and Debenture Offering, the Company first acquired the 1.5% gross revenue royalty on the Johnson Camp Mine from Greenstone in return for the Common Shares and Debenture and then transferred the royalty to Triple Flag for $5.5 million in cash. In addition, the holders of the $3 million principal amount of convertible debentures issued by the Company in February 2023 have agreed to extend the maturity date of such convertible debentures to September 30, 2026.

The Company also announces that, in connection with the Third Amendment to the Amended and Restated Credit Agreement with Nebari, it has issued 9,208,093 Common Shares to nominees of Nebari.

ABOUT EXCELSIOR MINING

Excelsior "The Copper Solution Company" is a mineral exploration and production company that owns and operates the Gunnison Copper Project in Cochise County, Arizona. The project is a low cost, environmentally friendly in-situ recovery copper extraction project that is permitted to 125 million pounds per year of copper cathode production. Excelsior also owns the past producing Johnson Camp Mine and a portfolio of exploration projects, including the Peabody Sill and the Strong and Harris deposits.

Excelsior has entered into an agreement with Nuton LLC, a Rio Tinto venture, to further evaluate the use of its Nuton™ copper heap leaching technologies at Excelsior's Johnson Camp mine in Cochise County, Arizona. Under the agreement, Excelsior remains the operator and Nuton funds Excelsior's costs associated with a two-stage work program at Johnson Camp. Nuton has provided a US$3 million pre-payment to Excelsior for Stage 1 costs and a payment of US$2 million for an exclusive option to form a joint venture with Excelsior over the Johnson Camp Mine after the completion of Stage 2. If Nuton proceeds to Stage 2, it will make a US$5 million payment to Excelsior for the use of existing infrastructure at the Johnson Camp mine for the Stage 2 work program. Nuton will also be responsible for funding all of Excelsior's costs associated with Stage 2.

For more information on Excelsior, please visit our website at www.excelsiormining.com.

For further information regarding this press release, please contact:

Excelsior Mining Corp.

Concord Place, Suite 300, 2999 North 44th Street, Phoenix, AZ, 85018.

Shawn Westcott

T: 604.365.6681

E: This email address is being protected from spambots. You need JavaScript enabled to view it.

www.excelsiormining.com

Cautionary Note Regarding Forward-Looking Information

This news release contains "forward-looking information" concerning anticipated developments and events that may occur in the future. Forward looking information contained in this news release includes, but is not limited to, statements with respect to: (i) the completion of the conditions to the Third Amended ARCA; (ii) the use of proceeds of the Share Offering and Debenture Offering; (iii) the details of the transaction with Nuton LLC and (iv) future production and production capacity from the Company's mineral projects.

In certain cases, forward-looking information can be identified by the use of words such as "plans", "expects" or "does not expect", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might", "occur" or "be achieved" suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions or statements about future events or performance. Forward-looking information contained in this news release is based on certain factors and assumptions regarding, among other things, the availability of financing to implement the Company's operational plans, the estimation of mineral resources and mineral reserves, the realization of resource and reserve estimates, expectations and anticipated impact of the COVID-19 outbreak, copper and other metal prices, the timing and amount of future development expenditures, the estimation of initial and sustaining capital requirements, the estimation of labour and operating costs (including the price of acid), the availability of labour, material and acid supply, receipt of and compliance with necessary regulatory approvals and permits, the estimation of insurance coverage, and assumptions with respect to currency fluctuations, environmental risks, title disputes or claims, and other similar matters. While the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect.

Forward looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include risks inherent in the construction and operation of mineral deposits, including risks relating to changes in project parameters as plans continue to be redefined including the possibility that mining operations may not be sustained at the Gunnison Copper Project, risks relating to variations in mineral resources and reserves, grade or recovery rates, risks relating to the ability to access infrastructure, risks relating to changes in copper and other commodity prices and the worldwide demand for and supply of copper and related products, risks related to increased competition in the market for copper and related products, risks related to current global financial conditions, risks related to current global financial conditions and the impact of COVID-19 on the Company's business, uncertainties inherent in the estimation of mineral resources, access and supply risks, risks related to the ability to access acid supply on commercially reasonable terms, reliance on key personnel, operational risks inherent in the conduct of mining activities, including the risk of accidents, labour disputes, increases in capital and operating costs and the risk of delays or increased costs that might be encountered during the construction or mining process, regulatory risks including the risk that permits may not be obtained in a timely fashion or at all, financing, capitalization and liquidity risks, risks related to disputes concerning property titles and interests, environmental risks and the additional risks identified in the "Risk Factors" section of the Company's reports and filings with applicable Canadian securities regulators.

Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. The forward-looking information is made as of the date of this news release. Except as required by applicable securities laws, the Company does not undertake any obligation to publicly update or revise any forward-looking information.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/191089

- Strong Support with Extension and Funding Provided by Three Major Stakeholders

- Provides Liquidity and Reduces Future Interest Obligation Under the Loan

Phoenix, Arizona--(Newsfile Corp. - November 30, 2023) - Excelsior Mining Corp. (TSX: MIN) (FSE: 3XS) (OTCQB: EXMGF) ("Excelsior" or the "Company") is pleased to announce that it and its wholly-owned subsidiary Excelsior Mining Arizona, Inc. ("Excelsior Arizona") has agreed with Nebari Natural Resources Credit Fund I LP ("Nebari") to extend the maturity date of its existing $15 million credit facility to June 30, 2026. In addition, the Company has entered into agreements for a $5.5 million financing (the "Financing") with Greenstone and Triple Flag. All dollar amounts in this press release are in United States dollars.

Dr. Stephen Twyerould, President & CEO of Excelsior commented: "We are very pleased with the support from Nebari, Greenstone and Triple Flag for the execution of the Company's development and operating strategy. The loan extension and funding will allow Excelsior the runway to advance the Nuton Option on the Johnson Camp Mine and complete the preparation for the well stimulation program."

Credit Agreement Extension

The Company, Excelsior Arizona and Nebari have entered into a Third Amendment to the Amended and Restated Credit Agreement (the "Third Amended ARCA"). The Third Amended ARCA provides for the extension of the maturity date of the existing $15 million credit facility to June 30, 2026 (the "Extension"). Nebari has also agreed to reduce the interest rate (the "Rate Reduction") to 10.5% plus a rate supplement (the "Rate Supplement") equal to the greater of (i) the forward-looking secured overnight financing rate (administered by CME Group Benchmark Administration Limited or a successor administrator) for a tenor of 3 months and (ii) 1.50%.

As consideration for the Third Amended ARCA as it relates to the Extension and Rate Reduction, subject to Toronto Stock Exchange approval, the Company is required to issue common shares of the Company ("Common Shares") to nominees of Nebari in a number equal to US$1,050,224, converted to Canadian dollars at an exchange rate equal to the average market rate posted by the Bank of Canada for the 5 days preceding the issuance, divided by C$0.155 (US$0.11405). This amount includes a cash extension bonus plus an amount equal to the total additional amount of interest that would have been payable to the maturity date of the credit facility prior to the Rate Reduction.

In addition the early amortization of the credit facility has been extended such that the Company will begin amortizing the principal amount of the facility (and pro-rata repayment bonus (the "Repayment Bonus") amount that already exists under the credit facility) in monthly instalments payable on the last day of each month of (i) commencing June 2024 to and including December 2024, seven equal monthly installments of $206,000.00; (ii) commencing January 2025 to and including December 2025, twelve equal monthly installments of $257,500.00; and (iii) commencing January 2026 to June 2026, six equal monthly installments of $309,000.00.

The Third Amended ARCA is subject to certain conditions including completion of the Financing by December 31, 2023, conclusion of certain agreements with Triple Flag International Ltd. ("Triple Flag") and the approval of the Toronto Stock Exchange.

Financing

To satisfy the condition to complete the Financing under the Third Amended ARCA, the Company has agreed to a transaction with Triple Flag and Greenstone Excelsior Holdings LP ("Greenstone") on the following terms: (i) Greenstone shall sell 1.5% of its total 3% gross revenue royalty on the Johnson Camp Mine to Triple Flag for consideration of $5.5 million in cash (the "Royalty Sale"); and (ii) Greenstone will concurrently complete a $5.5 million financing with the Company that consists of $3.1 million in Common Shares (the "Share Offering") and $2.4 million principal amount of convertible debentures (the "Debenture Offering").

Pursuant to the Share Offering, the Company shall issue Greenstone a total of 27,180,000 Common Shares at a price of US$0.11405 (C$0.155) per Common Share for aggregate gross proceeds of $3.1 million.

Pursuant to the Debenture Offering, Greenstone will subscribe for a total of $2.4 million principal amount of convertible debentures (the "Debentures"). The terms of the Debentures include:

- a maturity date of September 30, 2026 (the "Maturity Date") and the principal amount, together with any accrued and unpaid interest, will be payable on the Maturity Date, unless earlier converted in accordance with their terms;

- the Debentures bear interest (the "Interest") at the rate of 10.5% per annum plus the Rate Supplement, which Interest will be payable on the Maturity Date, unless earlier converted into Common Shares;

- subject to the receipt of disinterested shareholder approval from the holders of the Common Shares at a duly and validly call meeting (the "Shareholder Approval"), the principal amount of the Debenture is convertible into Common Shares at the option of the holder (or at the option of the Company on 30 days prior notice) at a conversion price of US$0.11405 per Common Share;

- subject to receipt of the Shareholder Approval, the accrued and unpaid Interest is convertible into Common Shares at a conversion price equal to the volume weighted average trading price on the Toronto Stock Exchange for the five trading days prior to the date of conversion; and

- the Debentures are unsecured.

The Company intends to use the proceeds of the Share Offering and Debenture Offering for project development expenses and working capital. The closing of the Share Offering and Debenture Offering is subject to customary conditions, including the approval of the Toronto Stock Exchange.

Additional Information

Nebari and Triple Flag are at arm's length to the Company. There are no commissions or finders' fees payable in connection with the transactions discussed in this news release. There is no assurance that the conditions to the Third Amended ARCA or closing of the Royalty Sale, Share Offering or Debenture Offering will be satisfied.

Greenstone and its affiliated entities currently hold 116,028,937 Common Shares (representing 41.86% of the Company's current issued and outstanding Common Shares). Greenstone also owns and controls 1,250,000 options to acquire Common Shares and a convertible debenture with principal amount of $1.5 million that is convertible into 7,894,736 Common Shares. Upon closing of the Debenture Offering and conversion of the Debentures held by Greenstone (assuming conversion of all interest payments on the maturity date, using a conversion price of US$0.11405 and a SOFR rate of 5.3307%), Greenstone would acquire ownership and control over an additional 57,383,369 Common Shares, representing approximately 20.7% of the Company's current issued and outstanding Common Shares. As a result, together with the Common Shares it currently owns and controls, Greenstone would hold a total of 173,412,306 Common Shares, which will represent, in aggregate approximately 51.83% of the issued and outstanding Common Shares (assuming conversion of only the Debentures held by Greenstone and assuming the conversion of all interest to maturity at US$0.11405).

Pursuant to Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101"), Greenstone's participation in the Debenture Offering constitutes a "related party transaction" as Greenstone is a related party of the Company. The Company is relying on an exemption from the formal valuation and minority shareholder approval requirements of MI 61-101 pursuant to exemptions contained in sections 5.5(a) and 5.7(1)(a) of MI 61-101 on the basis that at the time Greenstone's participation in the Debenture Offering was agreed to, neither the fair market value of the securities to be distributed in the Debenture Offering nor the consideration to be received for those securities, insofar as the Debenture Offering involved the related party, exceeds 25% of the Company's market capitalization. The Company will not file a material change report related to this financing more than 21 days before the expected closing of the Debenture Offering as required by MI 61-101 since the details of the participation by the related parties of the Company were not settled until just prior to closing and the Company wished to close on an expedited basis for sound business reasons. The Common Shares that will be acquired by Greenstone will be acquired pursuant to an exemption from the prospectus requirement in section 2.3 of National Instrument 45-106.

In order to facilitate the completion of the Royalty Sale, Share Offering and Debenture Offering, the Company will first acquire the 1.5% gross revenue royalty on the Johnson Camp Mine from Greenstone in return for the Common Shares and Debenture and then transfer the royalty to Triple Flag for $5.5 million in cash. Also, a further condition of the Third Amended ARCA, the holders of the $3 million principal amount of convertible debentures issued by the Company in February 2023 have agreed to extend the maturity date of such convertible debentures to September 30, 2026.

Other activities in the Company remain on-track and on-budget. Refer to the October 23, 2023 press release for additional information.

ABOUT EXCELSIOR MINING

Excelsior "The Copper Solution Company" is a mineral exploration and production company that owns and operates the Gunnison Copper Project in Cochise County, Arizona. The project is a low cost, environmentally friendly in-situ recovery copper extraction project that is permitted to 125 million pounds per year of copper cathode production. Excelsior also owns the past producing Johnson Camp Mine and a portfolio of exploration projects, including the Peabody Sill and the Strong and Harris deposits.

Excelsior has entered into an agreement with Nuton LLC, a Rio Tinto venture, to further evaluate the use of its Nuton™ copper heap leaching technologies at Excelsior's Johnson Camp mine in Cochise County, Arizona. Under the agreement, Excelsior remains the operator and Nuton funds Excelsior's costs associated with a two-stage work program at Johnson Camp. Nuton has provided a US$3 million pre-payment to Excelsior for Stage 1 costs and a payment of US$2 million for an exclusive option to form a joint venture with Excelsior over the Johnson Camp Mine after the completion of Stage 2. If Nuton proceeds to Stage 2, it will make a US$5 million payment to Excelsior for the use of existing infrastructure at the Johnson Camp mine for the Stage 2 work program. Nuton will also be responsible for funding all of Excelsior's costs associated with Stage 2.

For more information on Excelsior, please visit our website at www.excelsiormining.com.

For further information regarding this press release, please contact:

Excelsior Mining Corp.

Concord Place, Suite 300, 2999 North 44th Street, Phoenix, AZ, 85018.

Shawn Westcott

T: 604.365.6681

E: This email address is being protected from spambots. You need JavaScript enabled to view it.

www.excelsiormining.com

Cautionary Note Regarding Forward-Looking Information

This news release contains "forward-looking information" concerning anticipated developments and events that may occur in the future. Forward-looking information contained in this news release includes, but is not limited to, statements with respect to: (i) the completion of the conditions to the Third Amended ARCA; (ii) the closing of the Royalty Sale, Share Offering and Debenture Offering; (iii) the use of proceeds of the Share Offering and Debenture Offering; and (iv) future production and production capacity from the Company's mineral projects.

In certain cases, forward-looking information can be identified by the use of words such as "plans", "expects" or "does not expect", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might", "occur" or "be achieved" suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions or statements about future events or performance. Forward-looking information contained in this news release is based on certain factors and assumptions regarding, among other things, the availability of financing to implement the Company's operational plans, the estimation of mineral resources and mineral reserves, the realization of resource and reserve estimates, expectations and anticipated impact of the COVID-19 outbreak, copper and other metal prices, the timing and amount of future development expenditures, the estimation of initial and sustaining capital requirements, the estimation of labour and operating costs (including the price of acid), the availability of labour, material and acid supply, receipt of and compliance with necessary regulatory approvals and permits, the estimation of insurance coverage, and assumptions with respect to currency fluctuations, environmental risks, title disputes or claims, and other similar matters. While the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect.

Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include risks inherent in the construction and operation of mineral deposits, including risks relating to changes in project parameters as plans continue to be redefined including the possibility that mining operations may not be sustained at the Gunnison Copper Project, risks relating to variations in mineral resources and reserves, grade or recovery rates, risks relating to the ability to access infrastructure, risks relating to changes in copper and other commodity prices and the worldwide demand for and supply of copper and related products, risks related to increased competition in the market for copper and related products, risks related to current global financial conditions, risks related to current global financial conditions and the impact of COVID-19 on the Company's business, uncertainties inherent in the estimation of mineral resources, access and supply risks, risks related to the ability to access acid supply on commercially reasonable terms, reliance on key personnel, operational risks inherent in the conduct of mining activities, including the risk of accidents, labour disputes, increases in capital and operating costs and the risk of delays or increased costs that might be encountered during the construction or mining process, regulatory risks including the risk that permits may not be obtained in a timely fashion or at all, financing, capitalization and liquidity risks, risks related to disputes concerning property titles and interests, environmental risks and the additional risks identified in the "Risk Factors" section of the Company's reports and filings with applicable Canadian securities regulators.

Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. The forward-looking information is made as of the date of this news release. Except as required by applicable securities laws, the Company does not undertake any obligation to publicly update or revise any forward-looking information.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/189340

Phoenix, Arizona--(Newsfile Corp. - October 23, 2023) - Excelsior Mining Corp. (TSX: MIN) (FSE: 3XS) (OTCQB: EXMGF) ("Excelsior" or the "Company") is pleased to provide an update on the mining camp encompassed by the Gunnison Copper Project (Gunnison), the Johnson Camp Copper Mine (JCM) and Strong and Harris, located in Cochise County, southeastern Arizona.

Nuton — JCM Update

- In addition to the favorable drilling results which were previously announced on September 14, 2023 and October 16, 2023, Nuton related activities are progressing according to plan and remain on budget and on schedule. Nuton has begun running leaching tests with the NutonTM technologies.

- Should Nuton elect to move to Stage 2 of the project, then construction is anticipated to commence in H1 2024.

Gunnison Copper Project Update

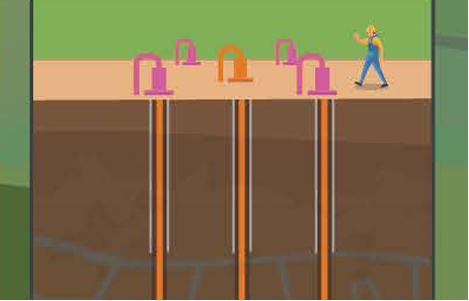

- Additional well stimulation modelling has recently been completed, which supports the results of prior modelling, indicating well stimulation has the potential to greatly improve flow, connectivity and permeability, thereby improving sweep efficiency and gas bubble removal. See October 18th 2022 News for prior modelling.

- Contractors have been identified for certain aspects of the well stimulation trails and long-lead item equipment has been acquired or ordered.

- Trials are subject to work plan approvals and additional working capital.

Mining Camp

- Excelsior is taking a broader and more integrated view of the entire mining camp under its control, including the potential for a large centralized processing facility taking advantage of the recent advances in sulfide leaching technology, like that provided by Nuton, combined with more traditional mining approaches like large open pit mining.

- Well stimulation at the Gunnison Copper Project remains the primary focus; however, the results of Excelsior's review may indicate favorable economics for open pit mining of Excelsior assets.

- The resource estimate the Gunnison Copper Project compares favorably to other proposed open pit mining operations in Arizona in terms of grade and tonnage.

- The concept of a larger, centralized processing facility being fed by traditional mining activities would benefit the nearby Strong and Harris project, which is located only 2 miles (3.2 km) north of Johnson Camp.

"There are relatively few large copper development projects in safe jurisdictions around the world that have our permitting track record and near-term production potential. That makes us very excited by the future of our mining camp. JCM, Strong and Harris and Gunnison have the combined potential for over 150 million pounds of copper per year assuming full production ramp up is achieved, which would make Excelsior a top 10 copper producer in Arizona," states Stephen Twyerould, President and CEO.

About Excelsior Mining

Excelsior "The Copper Solution Company" is a mineral exploration and production company that owns and operates the Gunnison Copper Project in Cochise County, Arizona. The project is a low cost, environmentally friendly in-situ recovery copper extraction project that is permitted to 125 million pounds per year of copper cathode production. Excelsior also owns the past producing Johnson Camp Mine and a portfolio of exploration projects, including the Peabody Sill and the Strong and Harris deposits.

Excelsior's exploration work on the Johnson Camp mine is supervised by Stephen Twyerould, Fellow of AUSIMM, President and CEO of Excelsior and a Qualified Person as defined by NI 43-101. Mr. Twyerould has reviewed and is responsible for the technical information contained in this news release.

For more information on Excelsior, please visit our website at www.excelsiormining.com.

For further information regarding this press release, please contact:

Excelsior Mining Corp.

Concord Place, Suite 300, 2999 North 44th Street, Phoenix, AZ, 85018.

Shawn Westcott

T: 604.365.6681

E: This email address is being protected from spambots. You need JavaScript enabled to view it.

www.excelsiormining.com

Cautionary Note Regarding Forward-Looking Information

This news release contains "forward-looking information" concerning anticipated developments and events that may occur in the future. Forward looking information contained in this news release includes, but is not limited to, statements with respect to: (i) the intention to deploy the Nuton® technology at the Johnson Camp mine and future production therefrom; (ii) the aim to commence construction at Johnson Camp in H1 2024; (iii) the benefits of well stimulation and the Company's plans for well stimulations; (iv) ) future production and production capacity from the Company's mineral projects; (v) the prospects of mining and leaching predominantly sulfide copper mineralization in partnership with Nuton; and (vi) the potential for a large centralized processing facility taking advantage of the recent advances in sulfide leaching technology, like that provided by Nuton, combined with more traditional mining approaches like large open pit mining.

In certain cases, forward-looking information can be identified by the use of words such as "plans", "expects" or "does not expect", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might", "occur" or "be achieved" suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions or statements about future events or performance. Forward-looking information contained in this news release is based on certain factors and assumptions regarding, among other things, the estimation of mineral resources and mineral reserves, the realization of resource and reserve estimates, expectations and anticipated impact of the COVID-19 outbreak, copper and other metal prices, the timing and amount of future development expenditures, the estimation of initial and sustaining capital requirements, the estimation of labour and operating costs (including the price of acid), the availability of labour, material and acid supply, receipt of and compliance with necessary regulatory approvals and permits, the estimation of insurance coverage, and assumptions with respect to currency fluctuations, environmental risks, title disputes or claims, and other similar matters. While the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect.

Forward looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include risks inherent in the construction and operation of mineral deposits, including risks relating to changes in project parameters as plans continue to be redefined including the possibility that mining operations may not be sustained at the Gunnison Copper Project, risks relating to variations in mineral resources and reserves, grade or recovery rates, risks relating to the ability to access infrastructure, risks relating to changes in copper and other commodity prices and the worldwide demand for and supply of copper and related products, risks related to increased competition in the market for copper and related products, risks related to current global financial conditions, risks related to current global financial conditions and the impact of COVID-19 on the Company's business, uncertainties inherent in the estimation of mineral resources, access and supply risks, risks related to the ability to access acid supply on commercially reasonable terms, reliance on key personnel, operational risks inherent in the conduct of mining activities, including the risk of accidents, labour disputes, increases in capital and operating costs and the risk of delays or increased costs that might be encountered during the construction or mining process, regulatory risks including the risk that permits may not be obtained in a timely fashion or at all, financing, capitalization and liquidity risks, risks related to disputes concerning property titles and interests, environmental risks and the additional risks identified in the "Risk Factors" section of the Company's reports and filings with applicable Canadian securities regulators.

Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. The forward-looking information is made as of the date of this news release. Except as required by applicable securities laws, the Company does not undertake any obligation to publicly update or revise any forward-looking information.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/184750

Phoenix, Arizona--(Newsfile Corp. - October 16, 2023) - Excelsior Mining Corp. (TSX: MIN) (FSE: 3XS) (OTCQB: EXMGF) ("Excelsior" or the "Company") is pleased to announce assay results at the Johnson Camp Mine (JCM) from the Stage 1 drilling with Nuton LLC ("Nuton"), a Rio Tinto venture. The program consists of drilling approximately 6,000 feet of PQ core, primarily for the purposes of further metallurgical evaluation. The samples from the drill program will be processed for mineralogy and tested using the Nuton™ process. The program is being funded by Nuton and carried out by Excelsior in connection with the previously announced Option to JV Agreement.

"We are very happy with the results of the Stage 1, Phase 2 drilling with all holes finishing in mineralization and intersecting over 200 feet (true thickness) of good grades, with all lower intersections averaging over 0.55% total copper (highlighted below). The results are sufficient to warrant some additional drilling to the south which will commence this month. Mineralogical and metallurgical testing has also commenced," comments Roland Goodgame, Senior Vice President Business Development.

All 13 planned holes have been drilled using diamond drill rigs to generate PQ sized core and assays have been returned for all holes. The Stage 1 program is divided into two phases. Phase 2 holes (designated PH2) were drilled above the mineralization from the east side of the Burro pit. These holes were designed to test the extent of the mineralization and provide further representative metallurgical samples. Assay results are included in Table 1 below. Stage 1, Phase 1 drilling results were previously announced on September 14, 2023.

Table 1. Assay results.

| Hole ID | From (Ft) | To (Ft) | Interval (Ft) | True Thickness (Ft) | TCu% |

| PH2-1 | 10 | 110 | 100 | 72.0 | 0.25 |

| 260 | 650 | 390 | 280.8 | 0.51 | |

| PH2-2 | 0 | 110 | 110 | 78.1 | 0.27 |

| 220 | 250 | 30 | 21.3 | 0.54 | |

| 280 | 602 | 322 | 228.6 | 0.48 | |

| PH2-3 | 0 | 80 | 80 | 56.8 | 0.22 |

| 236 | 570 | 334 | 237.1 | 0.60 | |

| PH2-4 | 6 | 72.5 | 66.5 | 45.9 | 0.26 |

| 240 | 546 | 306 | 211.1 | 0.58 | |

| PH2-5 | 170 | 548 | 378 | 272.2 | 0.61 |

| PH2-6 | 18 | 50 | 32 | 21.3 | 0.19 |

| 190 | 581 | 391 | 260.4 | 0.63 | |

| PH2-7 | 120 | 547 | 427 | 303.2 | 0.70 |

| PH2-8 | 130 | 522 | 392 | 236.8 | 0.49 |

All samples are prepared from manually split or sawn PQ core sections on site in Arizona. Split drill core samples are then sent to independent laboratory Skyline Assayers & Laboratories in Tucson, Arizona for Total Copper and Sequential Copper analyses. Standards, blanks, and duplicate assays are included at regular intervals in each sample batch submitted from the field as part of an ongoing Quality Assurance/Quality Control Program. Pulps and sample rejects are stored by Excelsior for future reference.

About The Johnson Camp mine

The Johnson Camp Mine ("JCM") has historically been an open pit, heap leach operation since Cyprus Minerals opened the property in the 1970's. The operation includes two open pits, a two-stage crushing-agglomerating circuit, a fully functioning SX-EW plant capable of producing 25 million pounds of cathode copper per year, a complete set of PLS and raffinate ponds, and full infrastructure (ancillary facilities, access, power, water, and communications).

An updated Preliminary Economic Assessment (PEA) incorporating conventional sulfide leaching (not Nuton) technology was announced February 22nd 2023. Mining of JCM would be by traditional open pit. The highlights of the PEA financial model, using a copper price of $3.75/lb, shows an after-tax NPV of US$180 million (7.5% discount rate), and an after-tax IRR of 30.4%. The results are tabulated below.

| Mine Life and post mining processing | ~20 years |

| Heap Leach Material Mined | 85.2 M ton |

| Total Copper Grade (CuT%) | 0.37% |

| Average LOM Total Copper Recovery* | 77% |

| Cu Produced | 492 M lb |

| Total Tonnage Mined | 196 M ton |

| Initial Mine Capital | $58.9 million |

| Total Operating Cash Cost ($/lb Cu)** | $2.24 |

| After-Tax NPV/IRR (7.5% discount rate) | $180.0M / 30.4% |

| *Total copper recovery includes a combination of oxide, transition and primary sulfide mineral recoveries. ** Includes all operating costs, site G&A, royalties, non-income taxes, salvage, reclamation and closure. |

The PEA is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the conclusions reached in the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

QUALIFIED PERSON

Excelsior's exploration work on the Johnson Camp mine is supervised by Stephen Twyerould, Fellow of AUSIMM, President and CEO of Excelsior and a Qualified Person as defined by NI 43-101. Mr. Twyerould has reviewed and is responsible for the technical information contained in this news release. Mr. Twyerould has verified the data disclosed in this news release, including sampling, analytical and test data underlying the information disclosed in this news release. Mr. Twyerould has verified that the results were accurate from the official assay certificates provided to Excelsior.

About Excelsior Mining

Excelsior "The Copper Solution Company" is a mineral exploration and production company that owns and operates the Gunnison Copper Project in Cochise County, Arizona. The project is a low cost, environmentally friendly in-situ recovery copper extraction project that is permitted to 125 million pounds per year of copper cathode production. Excelsior also owns the past producing Johnson Camp Mine and a portfolio of exploration projects, including the Peabody Sill and the Strong and Harris deposits.

For more information on Excelsior, please visit our website at www.excelsiormining.com.

About Nuton

Nuton is an innovative venture that aims to help grow Rio Tinto's copper business. At the core of Nuton is a portfolio of proprietary copper leach related technologies and capability - a product of almost 30 years of research and development. Nuton offers the potential to economically unlock copper from primary sulfide resources worldwide through leaching, achieving market-leading recovery rates, contributing to an increase in copper production from copper bearing waste and tailings, and achieving higher copper recoveries on oxide and transitional material. One of the key differentiators of Nuton is the potential to produce the world's lowest impact copper while having at least one Net Positive impact at each of our deployment sites, across our five pillars: water, energy, land, materials and society.

For further information regarding this press release, please contact:

Excelsior Mining Corp.

Concord Place, Suite 300, 2999 North 44th Street, Phoenix, AZ, 85018.

Shawn Westcott

T: 604.365.6681

E: This email address is being protected from spambots. You need JavaScript enabled to view it.

www.excelsiormining.com

Cautionary Note Regarding Forward-Looking Information

This news release contains "forward-looking information" concerning anticipated developments and events that may occur in the future. Forward looking information contained in this news release includes, but is not limited to, statements with respect to: (i) the intention to deploy the Nuton® technology at the Johnson Camp mine and future production therefrom; (ii) the timeline for additional assay results; (iii) the results of the preliminary economic assessment on Johnson Camp; (iv) future production and production capacity from the Company's mineral projects; (v) the prospects of mining and leaching predominantly sulfide copper mineralization in partnership with Nuton; (vi) future drill results; and (vii) the development timeline to mine Johnson Camp.

In certain cases, forward-looking information can be identified by the use of words such as "plans", "expects" or "does not expect", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might", "occur" or "be achieved" suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions or statements about future events or performance. Forward-looking information contained in this news release is based on certain factors and assumptions regarding, among other things, the estimation of mineral resources and mineral reserves, the realization of resource and reserve estimates, expectations and anticipated impact of the COVID-19 outbreak, copper and other metal prices, the timing and amount of future development expenditures, the estimation of initial and sustaining capital requirements, the estimation of labour and operating costs (including the price of acid), the availability of labour, material and acid supply, receipt of and compliance with necessary regulatory approvals and permits, the estimation of insurance coverage, and assumptions with respect to currency fluctuations, environmental risks, title disputes or claims, and other similar matters. While the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect.

Forward looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include risks inherent in the construction and operation of mineral deposits, including risks relating to changes in project parameters as plans continue to be redefined including the possibility that mining operations may not be sustained at the Gunnison Copper Project, risks relating to variations in mineral resources and reserves, grade or recovery rates, risks relating to the ability to access infrastructure, risks relating to changes in copper and other commodity prices and the worldwide demand for and supply of copper and related products, risks related to increased competition in the market for copper and related products, risks related to current global financial conditions, risks related to current global financial conditions and the impact of COVID-19 on the Company's business, uncertainties inherent in the estimation of mineral resources, access and supply risks, risks related to the ability to access acid supply on commercially reasonable terms, reliance on key personnel, operational risks inherent in the conduct of mining activities, including the risk of accidents, labour disputes, increases in capital and operating costs and the risk of delays or increased costs that might be encountered during the construction or mining process, regulatory risks including the risk that permits may not be obtained in a timely fashion or at all, financing, capitalization and liquidity risks, risks related to disputes concerning property titles and interests, environmental risks and the additional risks identified in the "Risk Factors" section of the Company's reports and filings with applicable Canadian securities regulators.

Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. The forward-looking information is made as of the date of this news release. Except as required by applicable securities laws, the Company does not undertake any obligation to publicly update or revise any forward-looking information.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/183913

Phoenix, Arizona--(Newsfile Corp. - September 14, 2023) - Excelsior Mining Corp. (TSX: MIN) (OTCQB: EXMGF) (FSE: 3XS) ("Excelsior" or the "Company") is pleased to announce assay results at the Johnson Camp Mine (JCM) from the Stage 1 drilling with Nuton LLC ("Nuton"), a Rio Tinto venture. The program consists of drilling approximately 6,000 feet of PQ core, primarily for the purposes of further metallurgical evaluation. The samples from the drill program will be processed for mineralogy and tested using the Nuton™ process. The program is being funded by Nuton and carried out by Excelsior in connection with the previously announced Option to JV Agreement.

"The initial drill results from the bottom of the Burro pit are high-grade, averaging around 1% copper. These grades are in-line with expectations in this area, which is why we remain excited about the prospects of mining and leaching this predominantly sulfide copper mineralization in partnership with Nuton," comments Roland Goodgame, Senior Vice President Business Development.

A total of 11 of the 13 planned holes have been drilled using diamond drill rigs to generate PQ sized core, with 5 of the drilled holes still awaiting assays. The program is divided into two phases. Phase 1 holes (designated PH1) were drilled from the bottom of the Burro open pit towards the east and northeast and were declined at about 35 degrees. These holes were designed to drill approximately parallel to the dip of the easterly dipping mineralized horizon. The purpose of this drilling is to collect a relatively large volume of representative material for metallurgical testing. Assay results are included in Table 1 below.

Table 1. Assay results.

| Hole ID | Length of Hole (Ft) | From (Ft) | To (Ft) | Interval (Ft) | Total Cu% |

| PH1-4 | 275 | 10 | 275 | 265 | 0.94 |

| PH1-4A | 280 | 11.5 | 280 | 268.5 | 1.02 |

| PH1-5 | 250 | 5 | 250 | 245 | 0.94 |

| PH1-5A | 274 | 13 | 274 | 261 | 1.68 |

| PH1-5B | 300 | 6 | 300 | 294 | 1.15 |

The PH1 series holes were drilled down the dip or at a low angle to the dip of the mineralized horizons and as such a true width is difficult to determine. The mineralized horizon in this area is typically 60 to 160 feet in true width, however the grades in these holes may not be applicable to that entire true width. This mineralization is exposed in the bottom of the Burro pit and is one of the main targets for the potential re-start of the Burro pit. The Phase one holes started in high-grade mineralization and all holes finished in mineralization indicating the mineralization continues down dip. Approximately the first half of the holes in Table 1 were sulfide dominant (pyrite and chalcopyrite), whilst the second half included some transitional and oxide copper mineralization.

Unlike the Phase 1 holes, the Phase 2 holes were drilled from high on the eastern wall of the open pit and were designed to intersect the mineralized horizons below at a high angle to bedding. No phase 2 assay results are available yet.

All samples are prepared from manually split or sawn PQ core sections on site in Arizona. Split drill core samples are then sent to independent laboratory Skyline Assayers & Laboratories in Tucson, Arizona for Total Copper and Sequential Copper analyses. Standards, blanks, and duplicate assays are included at regular intervals in each sample batch submitted from the field as part of an ongoing Quality Assurance/Quality Control Program. Pulps and sample rejects are stored by Excelsior for future reference.

About The Johnson Camp mine

The Johnson Camp Mine ("JCM") has historically been an open pit, heap leach operation since Cyprus Minerals opened the property in the 1970's. The operation includes two open pits, a two-stage crushing-agglomerating circuit, a fully functioning SX-EW plant capable of producing 25 million pounds of cathode copper per year, a complete set of PLS and raffinate ponds, and full infrastructure (ancillary facilities, access, power, water, and communications).

An updated Preliminary Economic Assessment (PEA) incorporating sulfide leaching technology was announced February 22nd 2023. Mining of JCM would be by traditional open pit. The highlights of the PEA financial model, using a copper price of $3.75/lb, shows an after-tax NPV of US$180 million (7.5% discount rate), and an after-tax IRR of 30.4%. The results are tabulated below.

| Mine Life and post mining processing | ~20 years |

| Heap Leach Material Mined | 85.2 M ton |

| Total Copper Grade (CuT%) | 0.37% |

| Average LOM Total Copper Recovery* | 77% |

| Cu Produced | 492 M lb |

| Total Tonnage Mined | 196 M ton |

| Initial Mine Capital | $58.9 million |

| Total Operating Cash Cost ($/lb Cu)** | $2.24 |

| After-Tax NPV/IRR (7.5% discount rate) | $180.0M / 30.4% |

| *Total copper recovery includes a combination of oxide, transition and primary sulfide mineral recoveries. ** Includes all operating costs, site G&A, royalties, non-income taxes, salvage, reclamation and closure. |

The PEA is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the conclusions reached in the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

QUALIFIED PERSON

Excelsior's exploration work on the Johnson Camp mine is supervised by Stephen Twyerould, Fellow of AUSIMM, President and CEO of Excelsior and a Qualified Person as defined by NI 43-101. Mr. Twyerould has reviewed and is responsible for the technical information contained in this news release. Mr. Twyerould has verified the data disclosed in this news release, including sampling, analytical and test data underlying the information disclosed in this news release. Mr. Twyerould has verified that the results were accurate from the official assay certificates provided to Excelsior.

About Excelsior Mining

Excelsior "The Copper Solution Company" is a mineral exploration and production company that owns and operates the Gunnison Copper Project in Cochise County, Arizona. The project is a low cost, environmentally friendly in-situ recovery copper extraction project that is permitted to 125 million pounds per year of copper cathode production. Excelsior also owns the past producing Johnson Camp Mine and a portfolio of exploration projects, including the Peabody Sill and the Strong and Harris deposits.

For more information on Excelsior, please visit our website at www.excelsiormining.com.

About Nuton

Nuton is an innovative new venture that aims to help grow Rio Tinto's copper business. At the core of Nuton is a portfolio of proprietary copper leach related technologies and capability - a product of almost 30 years of research and development. The Nuton technologies offer the potential to economically unlock known low-grade copper sulfide resources, copper bearing waste and tailings, and achieve higher copper recoveries on oxide and transitional material, allowing for a significantly increased copper production outcome. One of the key differentiators of Nuton is the potential to deliver leading environmental performance, including more efficient water usage, lower carbon emissions, and the ability to reclaim mine sites by reprocessing mine waste.

For further information regarding this press release, please contact:

Excelsior Mining Corp.

Concord Place, Suite 300, 2999 North 44th Street, Phoenix, AZ, 85018.

Shawn Westcott

T: 604.365.6681

E: This email address is being protected from spambots. You need JavaScript enabled to view it.

www.excelsiormining.com

Cautionary Note Regarding Forward-Looking Information

This news release contains "forward-looking information" concerning anticipated developments and events that may occur in the future. Forward-looking information contained in this news release includes, but is not limited to, statements with respect to: (i) the intention to deploy the Nuton® technology at the Johnson Camp mine and future production therefrom; (ii) the details of the drill program, including number of feet expected to be drilled; (iii) the results of the preliminary economic assessment on Johnson Camp; (iv) future production and production capacity from the Company's mineral projects; (v) the prospects of mining and leaching predominantly sulfide copper mineralization in partnership with Nuton; (vi) future drill results; and (vii) the development timeline to mine Johnson Camp.

In certain cases, forward-looking information can be identified by the use of words such as "plans", "expects" or "does not expect", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might", "occur" or "be achieved" suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions or statements about future events or performance. Forward-looking information contained in this news release is based on certain factors and assumptions regarding, among other things, the estimation of mineral resources and mineral reserves, the realization of resource and reserve estimates, expectations and anticipated impact of the COVID-19 outbreak, copper and other metal prices, the timing and amount of future development expenditures, the estimation of initial and sustaining capital requirements, the estimation of labour and operating costs (including the price of acid), the availability of labour, material and acid supply, receipt of and compliance with necessary regulatory approvals and permits, the estimation of insurance coverage, and assumptions with respect to currency fluctuations, environmental risks, title disputes or claims, and other similar matters. While the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect.

Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include risks inherent in the construction and operation of mineral deposits, including risks relating to changes in project parameters as plans continue to be redefined including the possibility that mining operations may not be sustained at the Gunnison Copper Project, risks relating to variations in mineral resources and reserves, grade or recovery rates, risks relating to the ability to access infrastructure, risks relating to changes in copper and other commodity prices and the worldwide demand for and supply of copper and related products, risks related to increased competition in the market for copper and related products, risks related to current global financial conditions, risks related to current global financial conditions and the impact of COVID-19 on the Company's business, uncertainties inherent in the estimation of mineral resources, access and supply risks, risks related to the ability to access acid supply on commercially reasonable terms, reliance on key personnel, operational risks inherent in the conduct of mining activities, including the risk of accidents, labour disputes, increases in capital and operating costs and the risk of delays or increased costs that might be encountered during the construction or mining process, regulatory risks including the risk that permits may not be obtained in a timely fashion or at all, financing, capitalization and liquidity risks, risks related to disputes concerning property titles and interests, environmental risks and the additional risks identified in the "Risk Factors" section of the Company's reports and filings with applicable Canadian securities regulators.

Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. The forward-looking information is made as of the date of this news release. Except as required by applicable securities laws, the Company does not undertake any obligation to publicly update or revise any forward-looking information.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/180555

Phoenix, Arizona--(Newsfile Corp. - August 16, 2023) - Excelsior Mining Corp. (TSX: MIN) (FSE: 3XS) (OTCQB: EXMGF) ("Excelsior" or the "Company") is pleased to announce that it has commenced drilling at Johnson Camp with Nuton LLC ("Nuton"), a Rio Tinto venture, to further evaluate the use of its Nuton™ copper heap leaching technologies at Excelsior's Johnson Camp mine in Cochise County, Arizona. The program consists of drilling 6,000 feet of PQ core for the purposes of further metallurgical evaluation. Once completed the samples will be processed for mineralogy and tested using the Nuton™ process. Results are expected late Q3, 2023. The program is being funded by Nuton and carried out in connection with the previously announced Option Agreement.

"Excelsior is now aggressively moving the Johnson Camp mine forward with the next stages of the work program with Nuton. The sulfide potential at JCM is significant and we are pleased to be working with Nuton to realize that potential. In parallel we continue to progress Gunnison towards well stimulation trials later this year," comments Robert Winton, Senior Vice President & General Manager of Operations of Excelsior.

Rio Tinto has developed the Nuton™ Technologies, an extensive portfolio of advanced copper heap leaching technologies targeted at primary sulfide minerals (including lower grade mineral deposits), which could not otherwise be processed using traditional leaching or sulfide processing technologies. These technologies offer the potential to produce additional copper in a cost-effective manner that has significant environmental benefits and reduces waste from new and ongoing operations.

ABOUT NUTON

Nuton is an innovative new venture that aims to help grow Rio Tinto's copper business. At the core of Nuton is a portfolio of proprietary copper leach related technologies and capability – a product of almost 30 years of research and development. The Nuton technologies offer the potential to economically unlock known low-grade copper sulfide resources, copper bearing waste and tailings, and achieve higher copper recoveries on oxide and transitional material, allowing for a significantly increased copper production outcome. One of the key differentiators of Nuton is the potential to deliver leading environmental performance, including more efficient water usage, lower carbon emissions, and the ability to reclaim mine sites by reprocessing mine waste.

ABOUT THE JOHNSON CAMP MINE

The Johnson Camp Mine is a past producing open pit, heap leach operation. The operation includes two open pits, a two-stage crushing-agglomerating circuit, a fully functioning SX-EW plant capable of producing 25 million pounds of cathode copper per year, a complete set of PLS and raffinate ponds, and full infrastructure (ancillary facilities, access, power, water, and communications).

An updated Preliminary Economic Assessment (PEA) incorporating sulfide leaching technology was announced February 22nd 2023. Mining of JCM would be by traditional open pit. The highlights of the PEA financial model, using a copper price of $3.75/lb, shows an after-tax NPV of US$180 million (7.5% discount rate), and an after-tax IRR of 30.4%. The results are tabulated below.

| Mine Life and post mining processing | ~20 years |

| Heap Leach Material Mined | 85.2 M ton |

| Total Copper Grade (CuT%) | 0.37% |

| Average LOM Total Copper Recovery* | 77% |

| Cu Produced | 492 M lb |

| Total Tonnage Mined | 196 M ton |

| Initial Mine Capital | $58.9 million |

| Total Operating Cash Cost ($/lb Cu)** | $2.24 |

| After-Tax NPV/IRR (7.5% discount rate) | $180.0M / 30.4% |

| * Total copper recovery includes a combination of oxide, transition and primary sulfide mineral recoveries. ** Includes all operating costs, site G&A, royalties, non-income taxes, salvage, reclamation and closure. |

The PEA is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the conclusions reached in the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

ABOUT EXCELSIOR MINING

Excelsior "The Copper Solution Company" is a mineral exploration and production company that owns and operates the Gunnison Copper Project in Cochise County, Arizona. The project is a low cost, environmentally friendly in-situ recovery copper extraction project that is permitted to 125 million pounds per year of copper cathode production. Excelsior also owns the past producing Johnson Camp Mine and a portfolio of exploration projects, including the Peabody Sill and the Strong and Harris deposits.

Additional information about the Gunnison Copper Project and Johnson Camp Mine can be found in the technical report filed on SEDAR at www.sedar.com entitled "Gunnison Copper Project Prefeasibility Study Update and JCM Heap Leach Preliminary Economic Assessment", dated effective February 1, 2023.

Excelsior's exploration work on the Gunnison Property and Johnson Camp properties is supervised by Stephen Twyerould, Fellow of AUSIMM, President and CEO of Excelsior and a Qualified Person as defined by National Instrument 43-101. Mr. Twyerould has reviewed and approved the technical information contained in this news release.

For more information on Excelsior, please visit our website at www.excelsiormining.com.

For further information regarding this press release, please contact:

Excelsior Mining Corp.

Concord Place, Suite 300, 2999 North 44th Street, Phoenix, AZ, 85018.

Shawn Westcott

T: 604.365.6681

E: This email address is being protected from spambots. You need JavaScript enabled to view it.

www.excelsiormining.com

Cautionary Note Regarding Forward-Looking Information

This news release contains "forward-looking information" concerning anticipated developments and events that may occur in the future. Forward-looking information contained in this news release includes, but is not limited to, statements with respect to: (i) the potential of well stimulation to improve performance of the Company's mineral projects; (ii) the intention to deploy the Nuton® technology at the Johnson Camp mine and future production therefrom; (iii) the details of the drill program, including number of feet expected to be drilled; (iv) the results of the preliminary economic assessment on Johnson Camp; and (v) future production and production capacity from the Company's mineral projects.

In certain cases, forward-looking information can be identified by the use of words such as "plans", "expects" or "does not expect", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might", "occur" or "be achieved" suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions or statements about future events or performance. Forward-looking information contained in this news release is based on certain factors and assumptions regarding, among other things, the amended permit will not be appealed, work plans will be approved in a timely manner, the availability of financing to implement the Company's operational plans, the estimation of mineral resources and mineral reserves, the realization of resource and reserve estimates, expectations and anticipated impact of the COVID-19 outbreak, copper and other metal prices, the timing and amount of future development expenditures, the estimation of initial and sustaining capital requirements, the estimation of labour and operating costs (including the price of acid), the availability of labour, material and acid supply, receipt of and compliance with necessary regulatory approvals and permits, the estimation of insurance coverage, and assumptions with respect to currency fluctuations, environmental risks, title disputes or claims, and other similar matters. While the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect.

Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include risks inherent in the construction and operation of mineral deposits, including risks relating to changes in project parameters as plans continue to be redefined including the possibility that mining operations may not be sustained at the Gunnison Copper Project, risks relating to an appeal of the permit amendment that delays its effectiveness, risks related to the delay in approval of work plans, variations in mineral resources and reserves, grade or recovery rates, risks relating to the ability to access infrastructure, risks relating to changes in copper and other commodity prices and the worldwide demand for and supply of copper and related products, risks related to increased competition in the market for copper and related products, risks related to current global financial conditions, risks related to current global financial conditions and the impact of COVID-19 on the Company's business, uncertainties inherent in the estimation of mineral resources, access and supply risks, risks related to the ability to access acid supply on commercially reasonable terms, reliance on key personnel, operational risks inherent in the conduct of mining activities, including the risk of accidents, labour disputes, increases in capital and operating costs and the risk of delays or increased costs that might be encountered during the construction or mining process, regulatory risks including the risk that permits may not be obtained in a timely fashion or at all, financing, capitalization and liquidity risks, risks related to disputes concerning property titles and interests, environmental risks and the additional risks identified in the "Risk Factors" section of the Company's reports and filings with applicable Canadian securities regulators.

Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. The forward-looking information is made as of the date of this news release. Except as required by applicable securities laws, the Company does not undertake any obligation to publicly update or revise any forward-looking information.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/177365

Phoenix, Arizona--(Newsfile Corp. - July 31, 2023) - Excelsior Mining Corp. (TSX: MIN) (FSE: 3XS) (OTCQB: EXMGF) ("Excelsior" or the "Company") is pleased to announce that it has entered into an Option Agreement (the "Agreement") with Nuton LLC, a Rio Tinto venture, to further evaluate the use of its Nuton™ copper heap leaching technologies at Excelsior's Johnson Camp mine in Cochise County, Arizona. Under the Agreement, Excelsior remains the operator and Nuton funds Excelsior's costs associated with a two-stage work program at Johnson Camp. Nuton will provide a US$3 million pre-payment to Excelsior for Stage 1 costs and a payment of US$2 million for an exclusive option to form a joint venture with Excelsior over the Johnson Camp Mine after the completion of Stage 2.

"We are very pleased to be moving Johnson Camp forward with Nuton. With their support and technologies, we have the potential to realize the value of the sulfide resources at Johnson Camp in a way that is both economical and beneficial to the environment. Johnson Camp has the potential to progress towards cash-flow whilst we continue to develop our other assets, including progressing Gunnison towards well-stimulation trials later this year," comments Stephen Twyerould, President and CEO of Excelsior Mining. "The strength of this agreement is that it allows both Gunnison and Johnson Camp to advance in parallel."

Rio Tinto has developed the NutonTM Technologies, an extensive portfolio of advanced copper heap leaching technologies targeted at primary sulfide minerals (including lower grade mineral deposits), which could not otherwise be processed using traditional leaching or sulfide processing technologies. These technologies offer the potential to produce additional copper in a cost-effective manner that has significant environmental benefits and reduces waste from new and ongoing operations.

Under the terms of the Agreement, the Stage 1 work program involves Excelsior completing diamond drilling, permitting activities, detailed engineering, and project execution planning. Nuton will complete mineralogy, predictive modelling, engineering and other test work. Based on the results of the Stage 1 work program, Nuton has the option to proceed to Stage 2. The Stage 1 work program is expected to commence in August and take 6 to 9 months to complete.

If Nuton proceeds to Stage 2, it will make a US$5 million payment to Excelsior for the use of existing infrastructure at the Johnson Camp mine for the Stage 2 work program. Nuton will also be responsible for funding all of Excelsior's costs associated with Stage 2. The full Stage 2 work program is anticipated to take up to five years but will proceed based on milestones related to engineering and mobilization, infrastructure and construction, mining, leaching, copper production and post-leach rinsing. Mining is expected to commence in year one. The completion of all milestones would result in full scale commercial production over several years at Johnson Camp utilizing NutonTM Technologies. Revenue from operations will first be used to pay back Stage 2 costs to Nuton and will then be credited to Excelsior's account.